Dividends have been known to provide a means of income for investors. Owning dividend-paying companies through exchange traded funds (ETFs) provides a way to access dividends in a more efficient way. ETFs may provide instant diversification at a low cost. We believe this appeals to advisors and their clients because picking dividend-paying stocks can be incredibly time-consuming.

Although some clients might think a 2-3% dividend is not much to get excited about, it’s important to remember that unlike interest payments, dividends from certain equities can compound, as the part of a company’s earnings not paid out as a current dividend is often reinvested to make future dividends bigger. However, the experienced investor knows that there is no guarantee a company will continually pay or increase its dividend.

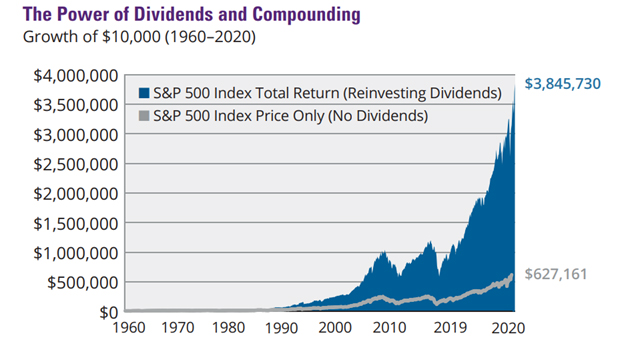

To illustrate this, we like to use the chart below, which shows $10,000 invested in the S&P 500 Index in 1960, with dividends reinvested versus the same amount and time period, but with no dividends reinvested.

Data Sources: Morningstar and Hartford Funds, 2/21. Past performance is no guarantee of future results. The S&P 500 Index is unmanaged and not available for direct investment. This chart is for illustrative purposes only. There is no guarantee that dividend-paying stocks will outperform non-dividend paying stocks in any market.

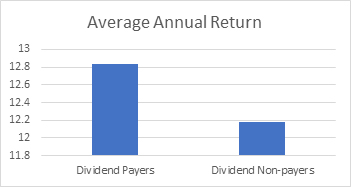

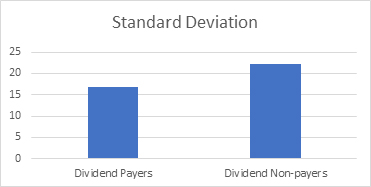

Historically, dividend-paying companies have also experienced higher average annual returns and reduced volatility.

Average Annual Return & Volatility by Dividend Policy for Stocks in the S&P 500 Index

Period: 1973-2020

Data Sources: Ned Davis Research and Hartford Funds, 2/21.

Past performance is no guarantee of future results. The chart is based on historical data and does not guarantee that any stock, whether dividend-paying or not, will experience lower volatility.

Advisors and investors find dividend-paying stocks appealing. But most investors and many advisors don’t have the time or resources to select individual stocks. It takes time to dig into why a stock’s dividend yield is high.

If you are one of the advisors that likes doing your own research and due diligence on companies, you’ll understand that dividend yields are calculated by taking the annual dividend payment and dividing it by the share price. The yield is shown as a percentage. A high dividend yield may be attractive or should be viewed as a red flag if, for example, the stock price dropped, causing the dividend to rise. Once you have that basic information, more research must be done on a company’s entire financial picture to understand the dividend.

That is why many advisors and most investors may want to consider investing in an ETF. Sound Income Strategies offers the Sound Equity Income ETF (ticker: SDEI) specifically for individuals planning for retirement or are already in retirement. SDEI is actively managed by a team that has been providing income-generating solutions to clients for 20 years. The ETF’s primary objective is to generate current income via a dividend yield that is targeted to be at least two times that of the S&P 500 Index. The Fund also seeks to capture long-term capital appreciation as a secondary objective. SDEI seeks to achieve its investment objectives by investing in common stock issued by dividend-paying, mid- and large-capitalization companies.

For retirees and those close to retirement, it may be worth considering a dividend income strategy. While dividend yields shouldn’t be the only factor in an investment decision, history has shown that dividends can help provide a source of possible income.

IMPORTANT INFORMATION

Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus. A prospectus may be obtained by calling (833) 916-9056 or visiting www.soundetfs.com. Please read the prospectus carefully before you invest.

Investing involves risk, including the potential loss of principal. There is no guarantee that the Funds investment strategy will be successful.

Since the Fund is actively managed, it does not seek to replicate the performance of a specified index. The Fund may frequently trade all or a significant portion of its portfolio; and have higher portfolio turnover than funds that do seek to replicate the performance of an index. Equity securities such as common stocks are subject to market, economic and business risks that may cause their prices to fluctuate.

The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. The securities of mid-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large-capitalization companies.

The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund.

Shares may trade at a premium or discount to their NAV in the secondary market. The Fund is new and has a limited operating history. The Fund has a limited number of financial institutions that are authorized to purchase and redeem shares directly from the Fund; and there may be a limited number of market makers or other liquidity providers in the marketplace. These and other risks can be found in the prospectus.

Diversification does not assure a profit or protect against a loss.

- Dividend Payers: Publicly traded companies that pay dividends to investors.

- Non-Dividend Payers: Publicly traded companies that do not pay dividends to investors.

- S&P 500 Index: A market capitalization-weighted index of the 500 largest U.S. publicly traded companies. It is not possible to invest directly in an index.

- Standard Deviation: A measure of the amount of variation or dispersion of a portfolio’s returns.

- Dollar-Cost Averaging: The strategy of consistently investing a fixed amount on a regular basis. This strategy may help avoid the risk of market timing but could limit potential upside.

The Fund is distributed by Foreside Fund Services, LLC.